The Excel NPV function is a financial function that is used to calculate the net present value of an investment by discounting the future cash flows to their present value. This function is very useful in financial analysis and decision making as it allows investors to evaluate the profitability of an investment in today’s dollars.

Excel NPV Function Summary

The Excel NPV function calculates the net present value of a series of future cash flows at a given discount rate. Understanding the concept of time value of money is crucial in various financial valuation methods. The NPV function determines the present value of future cash flows using an internal rate of return (IRR) that is specified as the discount rate. By default, the function assumes a 0% discount rate, but it can be adjusted to any desired rate. This function is a powerful tool for analyzing investment opportunities and evaluating the profitability of a project or investment.

NPV Function Purpose

The purpose of the Excel NPV function is to calculate the net present value of an investment. It is commonly used in financial analysis to evaluate the profitability of an investment.

NPV Function Arguments

The Excel NPV function requires two arguments: the discount rate and the series of cash flows.

NPV Function Return Value

The Excel NPV function returns the net present value of an investment.

NPV Function Syntax

=NPV(rate,value1,[value2],...)Excel NPV Function Examples

The NPV function is a powerful tool that can help you calculate the net present value of a series of cash flows. In this section, we’ll provide some examples of how to use the NPV function in Excel.

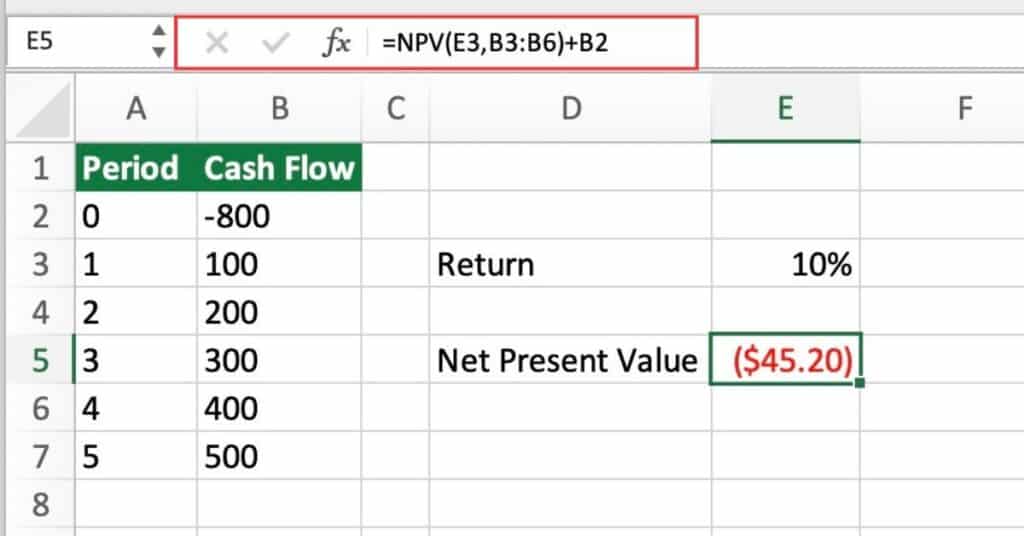

Calculating the net present value of a simple investment

Suppose you are considering investing $1,000 in a project that generates the following cash flows over three years: $150 in year one, $220 in year two, $375 in year three, $425 in year four, and $600 in year five. If the discount rate is 10%, what is the net present value of the investment?

=NPV(E3,B3:B7)+B2

This formula calculates the net present value (NPV) of a series of cash flows and adds an initial investment. Here is a breakdown of the formula:

- NPV(E3, B3:B7) calculates the net present value of the cash flows in the range B3:B7 using the discount rate specified in cell E3. The NPV function discounts each cash flow to its present value and then sums them up. The result of this calculation is the net present value of the cash flows.

- + B2 adds the initial investment in cell B2 to the net present value calculated in the first part of the formula. The initial investment represents the amount of money invested at the beginning of the project, and it is not included in the cash flows.

Calculating the net present value of an investment with uneven cash flows

Suppose you are considering investing $100,000 in a project that generates the following cash flows over five years: $20,000 in year one, $30,000 in year two, $40,000 in year three, $50,000 in year four, and $60,000 in year five. If the discount rate is 12%, what is the net present value of the investment?

Investment with Uneven Cash Flows you would need the following formula:

=NPV(12%, -100000, 20000, 30000, 40000, 50000, 60000)The net present value of the investment is $22,215.62.

NPV Function Notes

- The cash flows must be in chronological order and equally spaced.

- The discount rate must be expressed as a decimal.

- If the net present value is positive, the investment is expected to be profitable. If it is negative, the investment is expected to be unprofitable.